FACT SHEET

Why is Waste Heat to Power

Zero

Emission?

How does it differ from Combined Heat and Power?

WASTE HEAT TO POWER (WHP) IS A ZERO EMISSION WAY TO PRODUCE ELECTRICITY

- WHP converts, recovers, or recycles otherwise wasted heat from industrial processes to generate electricity or mechanical power, requiring no additional fuel and generating zero emissions.

- WHP is a stand-alone add-on unit; it harnesses heat through technology that is normally added after the existing facility is commissioned. WHP is independent of the primary industrial process of the facility.

- According to a 2021 study by ICF International, WHP systems offer a comparable emissions profile to wind and solar but due to their ability to run nearly 24/7, can provide greater annual emissions reduction than a comparable capacity solar or wind system.

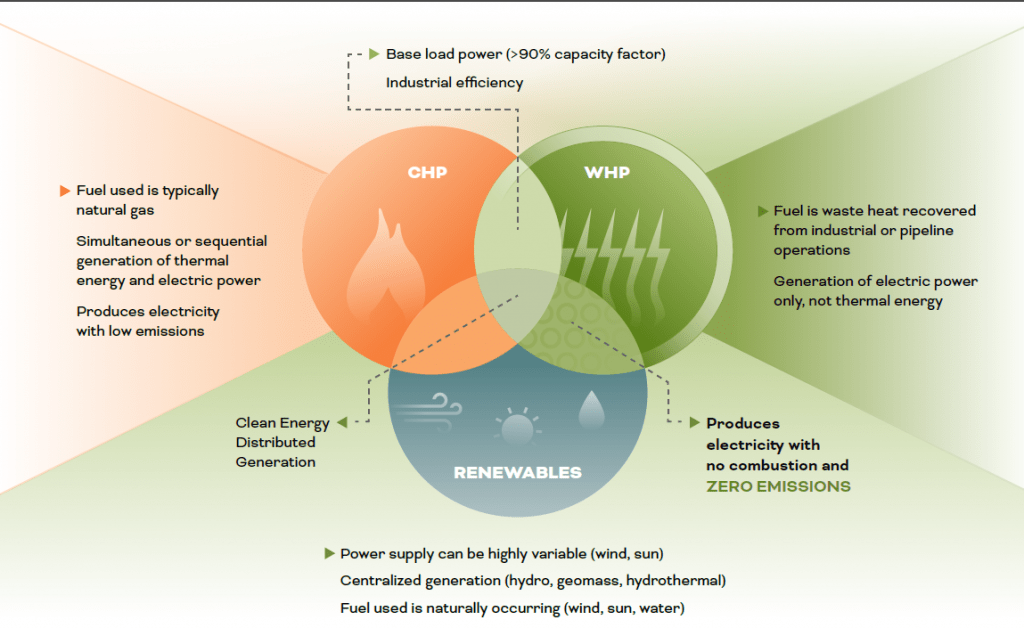

COMBINED HEAT AND POWER (CHP) IS A LOW EMISSION, ENERGY EFFICIENT WAY TO PRODUCE ELECTRICITY

- CHP burns fuel to generate electricity simultaneously or sequentially or to provide mechanical shaft power in combination with producing steam and/or thermal energy.

- CHP is an integrated system, and its primary purpose is to produce both thermal energy and electricity.

- CHP systems can be structured as zero emission if renewable fuels are used; whereas WHP is inherently zero emission since the source of power is always waste heat.

EVALUATING “ZERO-EMISSION”

- WHP can say YES to the following zero-emission criteria!

- Technology does not combust a fuel for the purpose of creating electricity.

- Fuel source to produce electricity is waste heat.

- No incremental greenhouse gases are released in the process of generating electricity.

- Does not require a Title V permit or similar air quality permits1 for a system (no need for Clean Air Act New Source Review).

-

1 May require an administrative change or minor modification to an existing permit depending on the state.

FEDERAL AND STATE POLICY TREAT WHP AS ZERO-EMISSION

- 20 States consider WHP to be a renewable resource eligible for a Tier 1 renewable portfolio standard and CHP to be an efficiency resource eligible for Tier 2.

- WHP has a distinctly different tax code definition from CHP.

- WHP has a distinctly different Energy Independence and Security Act definition from CHP.

- Federally, renewables receive a 30% Investment Tax Credit (ITC).

-

WHP historically received a 30% ITC.

CHP historically received a 10% ITC; but it was increased to 30% in the 2022 Inflation Reduction Act for 2 years.

- After 2025 only Clean Electricity Investment and Production Tax Credits will be available to zeroemission technologies on a technology-neutral basis.

OVERLAPPING BENEFITS OF CHP AND WHP

- Generate power on-site, eliminating the need for transmission and associated line losses.

- Can be a reliable source of 24/7 baseload power for manufacturing and other industrial facilities; has capability to achieve a high-capacity factor.

- Potentially provide excess electricity where electricity is delivered to the grid or used for the industrial process onsite.

- Serve as decarbonizing technologies that reduce emissions from the industrial sector.